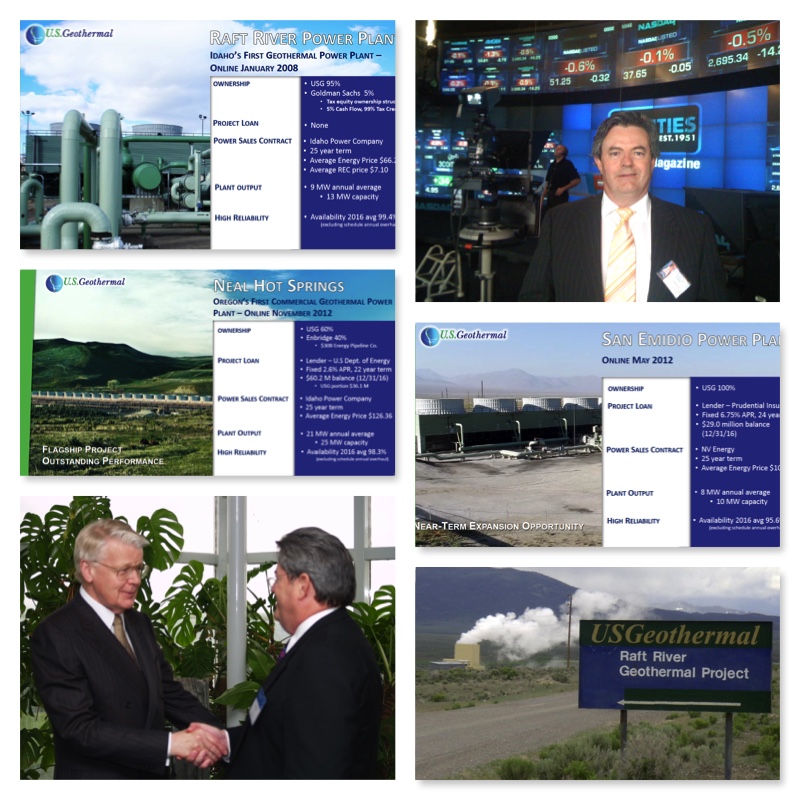

U.S.GEOTHERMAL POWER PLANTS, DANIEL KUNZ WITH ICELAND PRESIDENT GRIMSSON AND AT AMEX RINGING BELL CEREMONY

KUNZ AT DISCOVERY HOLE OYU TOLGOI, COMPUTER MODEL OF OYU TOLGOI, IVANHOE MInES PRESIDENT KUNZ WITH MONGOLIA PRESIDENT BAGBONDI, IVANHOE MINES CHAIRMAN ROBERT FRIEDLAND, AND MYANMAR SR GENERAL MAUNG AYE

Butte Montana

Daniel Kunz came from Butte, Montana where copper and mining formed the foundation of the city and state for decades. The deep copper mines were world famous and produced much of the nation’s copper and other metals during the electrification of the country and the first world war. By the mid 1950s some of the deep mines were uneconomic and so bulk open pit mining began at the Berkeley pit. By the mid 1970s the economics of deep mining in Butte forced the closure of the Kelley and Stewart the last of the great shaft mines in Butte.

Working for Anaconda Company as a geologic technician from 1973 to 1977, Kunz participated in core cutting and logging for the new Continental East molybdenum rich ore deposit. He saw first-hand many of the hundreds of drill core as he cut them for assay. But the writing was on the wall as the deep mines began to flood when the pumps were shut down leading to the eventual flooding of the Berkeley Pit.

In 1977, Kunz moved to coal since copper was dead and worked a few years for Peter Kiewit Sons Company in Omaha. Very late one evening, as Kunz was working on a new technology computer model of a Kiewit coal mine, he met another mentor, Mr. Peter Kiewit, who lived on the top floor of the office building and heard about this new computer model and arrived in his slippers and robe and spent hours asking questions and seeing for himself.

Soon Kunz was hired by a Kiewit competitor, Morrison Knudsen Corporation, in the Mining Group. One of the first development projects Kunz presented was the acquisition of the Anaconda Co from ARCO. Having first-hand knowledge of the massive Continental ore deposit and knowing that, with the Butte concentrator, vast array of open-pit mining equipment and rail and other infrastructure in place, a plan to open the Continental pit and sell moly-rich copper concentrates to Japan would be very successful. Spending months working on the plan, traveling back and forth from Boise to Butte, and obtaining key tax and power rate concessions, Kunz prepared and presented the plan to MK senior management. Needing approximately $10 million in cash, the plan was not able to be executed due to MK’s financial condition at the time. The plan somehow made its way to Missoula, MT and for the next few weeks Kunz was called many times by Mr. Dennis Washington who ask detailed questions about the plan. Soon Washington purchased the Montana operations and became very wealthy. Kunz suggested to Washington that he would become the 4th copper king in Butte history.

(top) KUNZ WITH KRYGYSTAN PRESIDENT ASKAR AKAYEV, (middle) ED FLOOD and CHYODA TEAM AT S&K FIRST CATHODE,(bottom left) with NIGERIA PRESIDENT abdulsaalmi ABUBAKER, (bottom right 2nd from right) with HUGO DUMMETT in tokyo

(top) mk gold board 1994: steven chi, sen gordon humphrey, james miscol, daniel kunz, william agee, robert hansberger, robert “bobby” shriver, robert tinstman. (bottom left) kunz with mongolian deputy minister of mines jargalshain, (bottom right) anaconda metallurgist lester zeihen, daniel and carol kunz, dana and george burns sr, mary jane and dr george brimhall

Boise, Idaho

At MK, coal was the key commodity but by the mid 1980s Kunz co-founded a subsidiary called MK Gold Company. MK Gold was providing contract mining services to the hard rock industry including some junior Canadian mining companies including Eastmaque Gold and headed by Mr. Adolph Lundin, Lundin approached MK Gold to be partners in Eastmaque’s American Girl mine project in California. As a 50-50 partner and contract miner, MK Gold had its first equity interest in a gold project. Lundin and his team, including Lukas Lundin, Bill Rand and Brian Edgar became life-long friends. MK Gold expanded by acquiring equity interests in Castle Mountain gold project in California, Jeroo gold project in Kyrgyzstan, Boroo gold project in Mongolia, and was contract miner for the Copperstone gold mine in Arizona and explorer with Arlo Resources in Panama, and Orvana Minerals in Bolivia.

In late 1993, MK did an IPO of MK Gold Company, listed on the NASDAQ and raised $80 million. Kunz was President, CEO and Director of the company. In the mid 1990s Ross Beaty acquired the Lundin interests in American Girl and became a partner. In 1996, MK Gold was acquired by Leucadia National Corp. Kunz then began a career in small mining company exploration and development by joining Indochina Goldfields, headed by Robert Friedland and Ed Flood. Indochina was renamed Ivanhoe Mines, Ltd. and Kunz became President, COO and Director. Kunz headed the development, finance and construction of the S&K copper mIne in Myanmar. The mine produced LME grade A copper cathodes, was ISO certified for its environmental stewardship, and employed and trained hundreds of local people.

In late 1998 Ivanhoe Mines ventured into Mongolia, where it acquired a property from BHP/Magma Copper and began an aggressive exploration program in the Gobi desert. In 2001, the discovery hole into Oyu Tolgoi drilled. The discovery led to some 14 drill rigs turning around the clock to define one of the world’s largest copper-gold deposits.

By 2003, Kunz determined that too much international travel was not good for his growing family and made the decision to retire from Ivanhoe Mines. By then, Kunz had founded a private geothermal energy company, acquired the Raft River DOE test site in SE Idaho, assembled a team of capable individuals, and arranged financing. The company, U.S. Geothermal, Inc., was listed on the AMEX and TSE exchanges. At Raft River in the 1970s the U.S. Department of Energy (“DOE”) drilled some 5 approximately 1,500 feet deep, large diameter geothermal wells and built the first binary cycle demonstration power plant. By 2007 Kunz and his team had built a new-generation binary cycle plant on the site utilizing the existing well-field and transmission line to generate some 10 MW of base-load green power. Two more power plants were developed and built over the next several years: one in San Emilio desert near Gerlach, Nevada and the other on Bully Creek near Vale, Oregon. The combined electrical output of the three plants are about 42 MWs, enough green electricity to power some 45,000 homes. About 75% of the power is sold to Idaho Power Company under long term contracts. For U.S. Geothermal, Kunz arranged a total of $315 million in financing from sources such as: DOE drilling grants, a 20-year DOE project loan, Production Tax Credit sale to Goldman Sachs, partnership contribution by Enbridge,Inc., Investment Tax Credit sales, a project loan from Prudential Financial, and equity raises by Canadian and US investors. In the early stages of the company, Kunz was working as acting COO and CFO in addition to his duties as Founder and CEO.

In 2013, after 12 years of hard work, successful growth, and the creation of a sustainable cash flowing business, coupled with his desire to get back to mineral development and no longer be affiliated with certain distasteful board members, Kunz retired from the company. In 2018, U.S.Geothermal was sold to ORMAT, a competitor, due to management’s inability to grow further after 2013.

In 2014, Daniel Kunz & Associates, LLC was formed.